By Deborah Foy, Agricompas

Over the past few months, the team at Agricompas has been working closely with FEDECACAO in Colombia to conduct value chain analysis for cocoa. This blog introduces the concept of value chain analysis and highlights how value chains can be used to make cocoa farming more sustainable.

What is Value Chain Analysis?

At its heart, value chain analysis describes the pathway of cocoa from bean to bar. It extends all the way from pre-farm input providers right through to end consumers, linking different actors in the chain along the way and highlighting where there are both threats and opportunities.

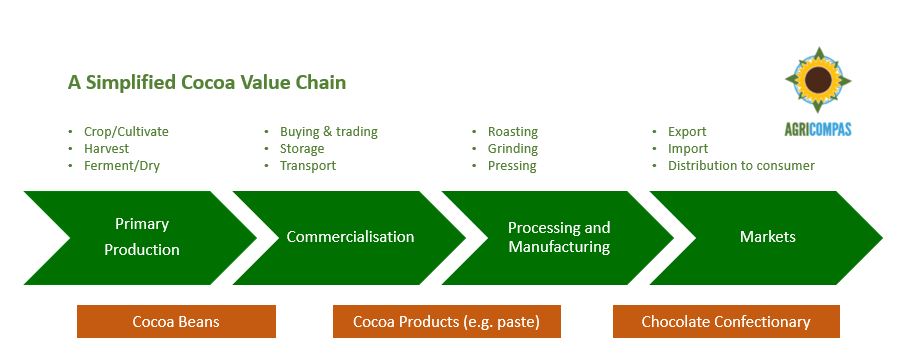

Typically, the main segments of a value chain are summarised in a value chain map. This map becomes a graphical representation of the value chain that showcases the functions of stakeholders, their relationships and the agents supporting the process. A simplified value chain map for cocoa is shown below:

The Main Stages of a Cocoa Value Chain

A typical cocoa bean value chain involves the operation of four major segments – Primary Production, Commercialisation, Processing and Manufacturing, and Market.

1. Primary Production

Farmers are at the primary production stage of cocoa-based supply chains. In Colombia, this group encompasses over 52,000 cocoa smallholders. Whilst the area planted by the farmers varies between regions, a typical cocoa farm in Colombia is grown on an average plot size of less than three hectares. Farmers in the primary production stage can be classified in many ways, including:

- Farm management practices (e.g. diversification of production)

- Percentage of shade cover

- Whether they are certified

- Whether their production methods are traditional or there is a high degree of technification

2. Commercialisation

Commercialisation can include individual purchasers, producer associations such as our local partner, the Federación Nacional de Cacaoteros (FEDECACAO), and the purchasing agents of large firms. This stage typically includes transportation, quality control, fermenting and drying, as well as differentiation (e.g. certification of producers that have met criteria of an independent evaluating entity). Some agents active in the commercialisation of cocoa – including our partner FEDECACAO – are involved in technical assistance and in the distribution of farming inputs such as fertiliser.

3. Processing and Manufacturing

In this stage, cocoa moves from commercialisation to firms involved in the transformation of cocoa and in the production of cocoa-based products (e.g. chocolate bars and cosmetics). In Colombia, two large domestic companies – Casa Luker and Nutresa – dominate the processing and manufacturing of cocoa. Together, they purchase between 80-90% of Colombia’s cacao production. Most central cocoa traders in Colombia have commercial relationships with one or other of these two major chocolate companies.

4. Markets

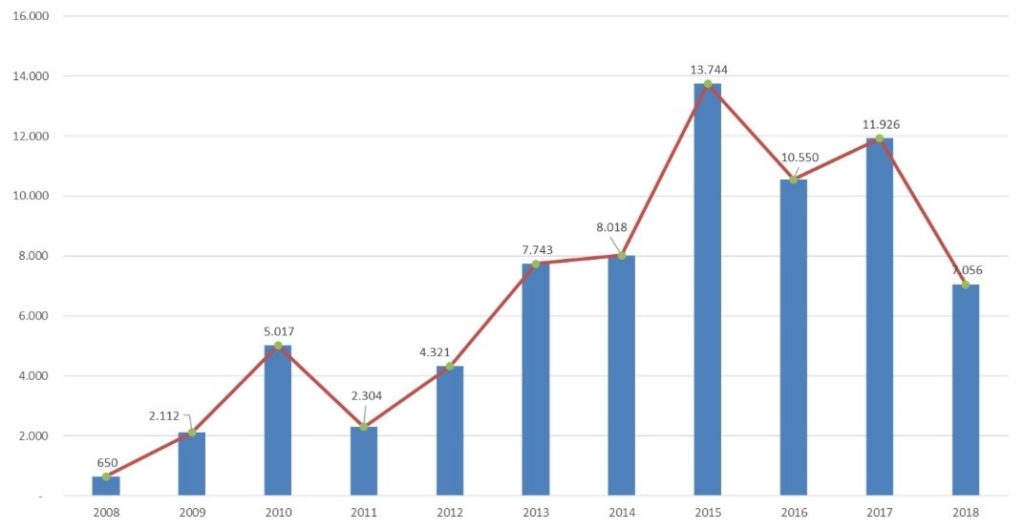

In this last stage, the processed cocoa is sold for internal (domestic) consumption or sent to export destinations. Colombia is unusual in that 81% of the final product is sold domestically, largely for drinking chocolate preparations (FEDECACAO 2019). However, exports of Colombia cocoa have been increasing since 2012. The country currently exports fermented and dried cocoa beans, shells and cacao residues, cacao paste, cacao butter, cacao fat or cacao oil, cacao powder without the addition of sugar and other food preparations containing cacao to around 72 countries.

How is Value Chain Analysis Useful for Sustainable Agriculture?

Value chain mapping has many uses. Key among them are the following:

- Identifying points of economic inefficiency: This includes economic analysis of points in the chain where resources are not being used in an optimal way.

- Identifying the value added at each step of the chain: In cocoa, value added at each step of the value chain is typically unequally distributed – meaning that benefits from price increases tend to benefit the agroindustry more than smallholder farmers.

- Identifying smallholder farmers who adopt practices that lead to sustainable agricultural outcomes: This can improve productivity through the creation of price premiums and incentive structures. The value chain can also help large firms to promote climate smart agriculture at primary production stage (e.g. through the reduction of greenhouse gas emissions).

- Identifying how value chain links can be improved: Better value chain links (e.g. between producer associations and buyers) can also improve farmer access to extension services, information about prices and certification, as well as inputs for climate adaptation and resiliency.

In Colombia, there are multiple forces that shape the supply and demand of cocoa. At Agricompas, we’re using value chain analysis tools to map out the roles and responsibilities of different actors involved in the sector. We’re using these tools to gain insight into the net income derived by farmers and other stakeholders from cocoa production and trade. Ultimately, understanding how the value chain works will help us to identify ways to make it more sustainable.